Purchasing a car can be stressful enough at the best of times, especially if you have a poor credit history, are in an IVA, have a CCJ or are perhaps self-employed or a young driver.

But were you aware that making changes to your insurance mid-policy could put you out of pocket?

—

Changing the name, address or job title on your car insurance policy seems straightforward enough, but you’ll often find that there can be a fairly hefty admin fee attached to making such a simple change.

Our team of car finance specialists analysed the term and conditions of over 80 of the UK’s car insurance providers to see how much they charge to make small changes to your policy information.

While we found that the majority of insurance providers we looked at (28%) actually didn’t charge anything to make changes to your policy, but of the 86 providers that we looked at, the average cost to change details on your car insurance policy came out as £22.50.

However, not all providers charge a flat admin fee. We found 11 providers that charge a different amount depending on exactly what it is that you’re changing.

For example, one of the providers allows you to change personal details such as your name, occupation and marital status for free but can charge as much as £35 for a change of address.

It’s important to remember that on top of these admin fees, you’ll often also have an increase on your premium to pay as well!

The Highest/Lowest Admin Fees

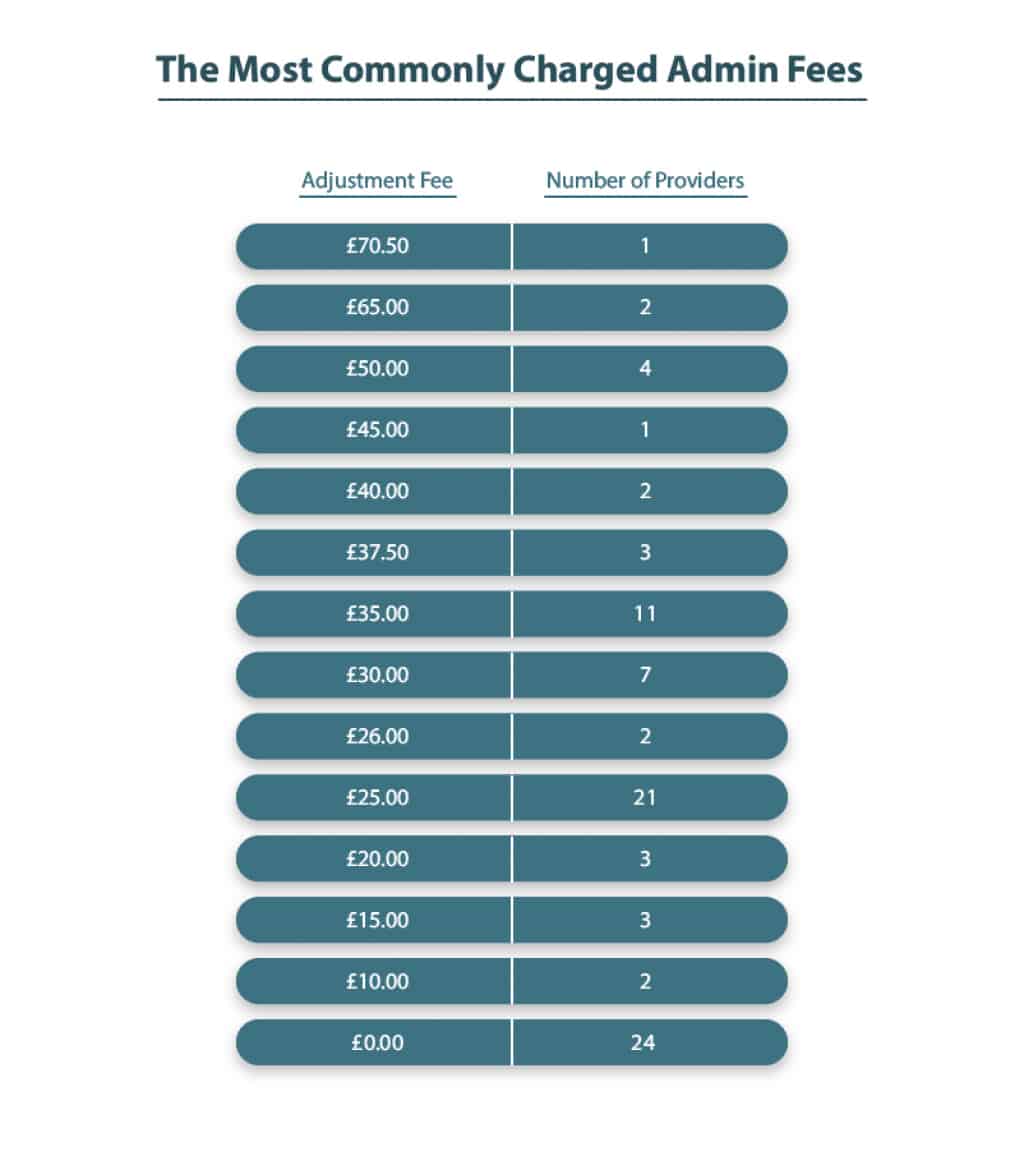

The Most Commonly Charged Admin Fees

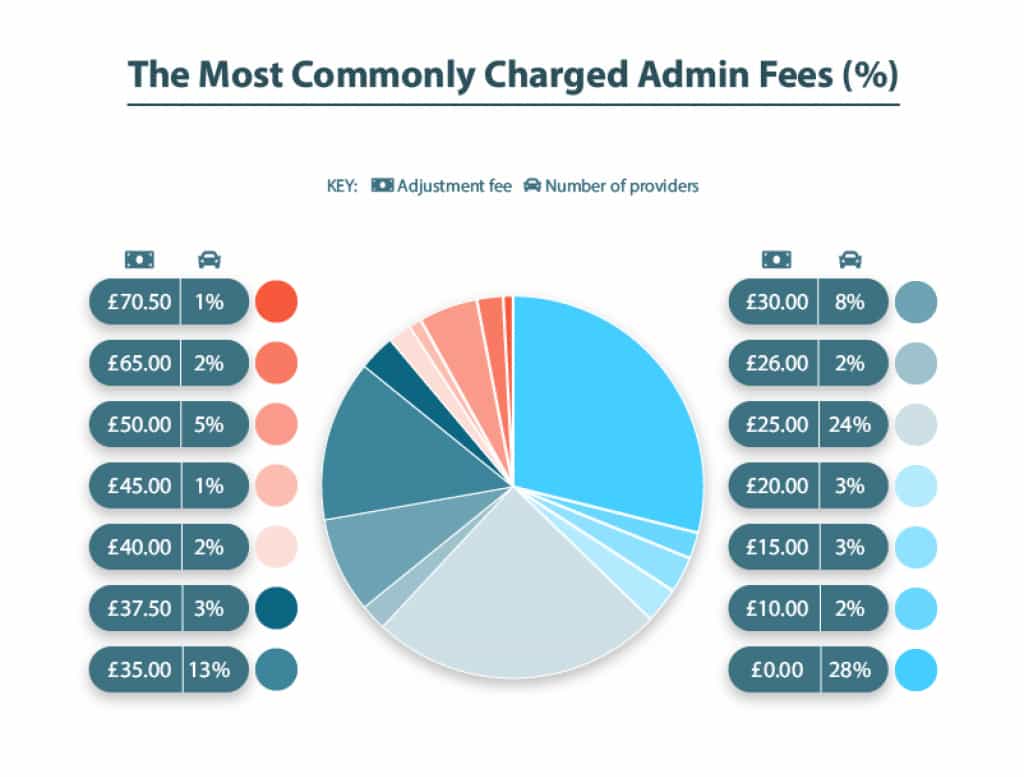

The Most Commonly Charged Admin Fees (%)

While the average amendment fee across all providers was £22.50, many providers charged much higher to make amendments.

The most expensive adjustment fee that we found was £70.50, although the provider in question vaguely stated that a change to your policy could cost anything from £17.50 to £70.50, without providing further details on exactly what would incur which charges.

However, some of the other insurance companies had flat charges of as much as £65 for making mid-term alterations to your policy, including basic things such as a change of address.

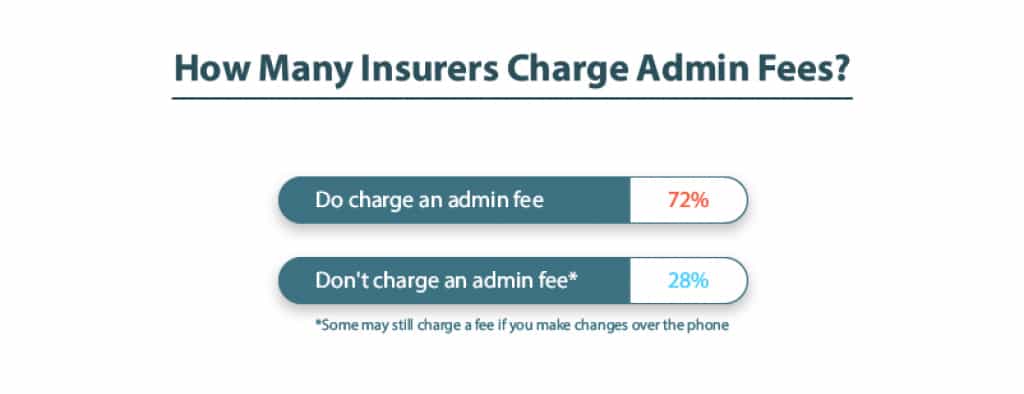

How Many Insurers Charge Admin Fees?

Around three-quarters of insurers do charge an admin fee to make changes to your policy, although a quarter actually don’t charge anything at all.

In the majority of these cases, the provider will provide you with an online portal allowing you to make the changes yourself, but if you call them up to make the change, they’ll still charge you an admin fee (sometimes as much as £35), so it’s important that you check whether or not you’re able to make changes by yourself for free before giving your insurer a call!

This is because the admin fee that you’re paying is to cover the time of the employee sat in a call centre who has to make the changes to your account, but in truth, all it usually takes is a couple of clicks!

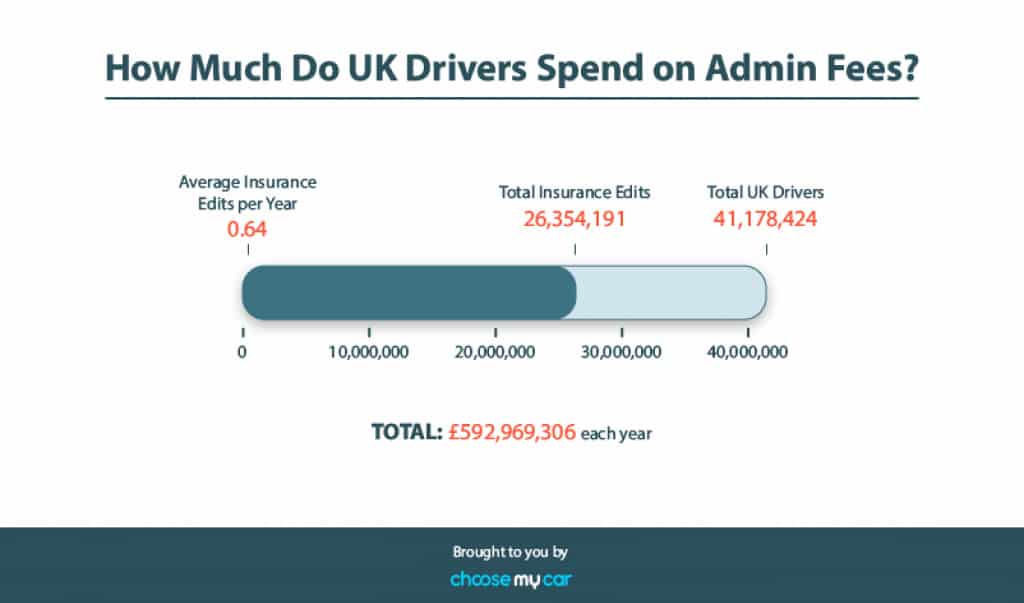

How Much Do UK Drivers Spend on Admin Fees?

So, how do all of these admin fees stack up across the whole country? Our research found that the average UK driver makes less than one change a year to their car insurance policies (0.64 on average).

But with over 41 million drivers on the UK’s roads, that equates to about 26 million policy adjustments, which at an average cost of £22.50, is costing UK drivers a total of £592,969,306 each year!

Methodology

We looked at 86 insurance providers from the UK and took the administration fee that each one charges to make alterations to a car insurance policy.

If an insurer had multiple charges depending on factors such as what details you’re changing, we took the most expensive charge.

We also had to omit some insurer which didn’t make it clear whether or not they charge an administration fee.

To calculate the total amount spent on admin fees by UK drivers, we conducted a survey through Maru/Usurv which revealed that the average person makes 0.64 changes to their car insurance policy each year.

We then multiplied this by the number of full driving license holders in the UK (according to DVLA data) to find the total number of changes made in a year and multiplied this by our average admin fee of £22.50.