Hire Purchase (HP)

Compare Hire Purchase (HP) offers and you could reduce your monthly payments.

- Flexible Repayments

- You Own The Vehicle

- Accessible to All: Even with a less-than-perfect credit score

Rates from 9.9% APR. Representative APR 21.9%. ChooseMyCar is a credit broker, not a lender.

Understanding Hire Purchase (HP) – What Is It?

If you want to buy a car but you can’t afford to buy it with cash, Hire Purchase – or HP – is the quickest, slickest and simplest way to do it. But what do you need to know if you’re considering a HP deal, and what should you watch out for?

Join us as we dig deep into the world of Hire Purchase,…

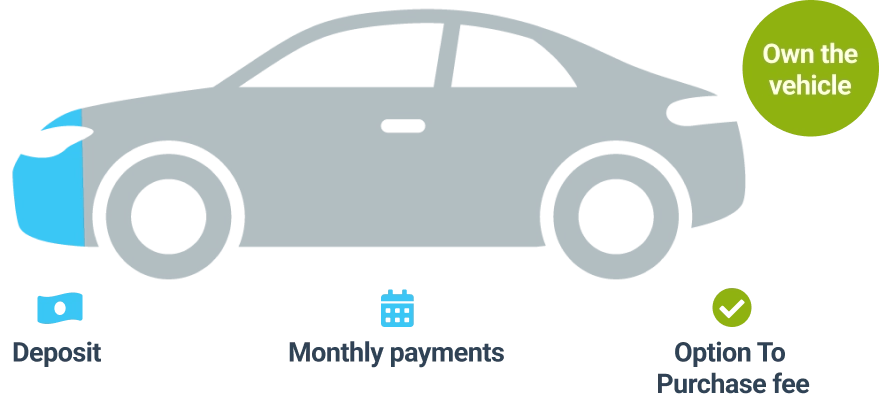

Simplicity is the key to Hire Purchase Car Finance. It’s the simplest form of Finance around: Just pay a deposit and then pay the remaining value of the car in instalments. Some HP deals don’t even require a deposit.

You get to drive the car from day 1 and it’s entirely yours when you’ve paid your last installment a few years later. It’s as simple as that.

HP Finance Calculator

Estimated Monthly Budget

Total Cost of Credit

£22,258

Optional Final Payment

£0

Pros and Cons of Hire Purchase

Pros of Hire Purchase

-

It’s Easy!

There’s no simpler Finance solution when you’re shopping for a new or used car. No faffing about with balloon payments or complicated calculations: just pay for the car and a little extra in APR. -

Drive Away Straight Away

No need to wait until you’ve saved up for the full cost of the car: you can start driving from the moment you put down your deposit or start paying instalments. See a car you want: set up your deal: Drive away. -

You ALWAYS Own The Car At The End*

Unlike leasing or PCP, there’s no other outcome, *so long as you keep up your repayments. The moment your last instalment is made, the car is 100% yours. Keep it, sell it, give it to your kids, fire it into space – it’s entirely up to you.

Cons of Hire Purchase

-

There are Cheaper Monthly Options

Because you’re paying the whole cost of your car between your deposit and your repayments, your monthly expenses can be higher than with PCP deals and Leasing. PCP and Leases hold a big chunk of the car’s overall value until the end of the Finance Period so you pay less every month, though you may not end up with a car at the end. -

Shorter Terms Cost More

Remember: you’re paying the entire cost of the car over the length of your Finance so if you want a shorter repayment period your monthly costs will go up. -

You Could Pay More Overall.

As APR is charged as a proportion of the whole amount you’re paying, you’ll be paying a bigger chunk of APR over the length of your Finance than you might with other Finance options.

How to calculate your Hire Purchase (HP)

-

The Price of The Car

The price of the car you want dictates the amount you want to borrow. The more expensive the car, the more it will cost overall.

-

Your Deposit

Here’s where it gets interesting. Find a car that’s likely to depreciate less and your monthly repayments might actually go down. Cars with lots of options, bells and whistles might actually cost less per month than bare bones models because they hold their value better.

-

The Length of Finance Agreement

The more money you put in up-front, the lower your monthly repayments and the less you’ll pay in APR overall but remember: If you hand your car back and walk away at the end you don’t get your deposit back.

-

A Matter of Interest

PCP contracts usually last between 2 and 4 years. The longer the repayment period, the less you’ll pay each month but the more you’ll pay overall in APR and Fees. The shorter your contract, the cheaper it’ll be in APR but it might cost you more each month.

Hire Purchase: What Makes It Different?

HP is the most straightforward form of Car Finance you can get. Unlike Leasing or PCP deals, there are no final payments, no chopping and changing calculations to make the Lender happy and no ifs or buts about driving away with a car.

Leasing

With a Lease you don’t ever own the car, you just pay to use it. Not so with HP: the car is always yours at the end of your agreement. Leasing is often much cheaper every month than HP. Because the Lender is betting that the car is worth a big chunk of change when they take it back, they only really charge you depreciation and fees to drive it. They’ll sell it for a profit later. Leasing is often the cheapest monthly option. Some Lenders don’t offer Leases on used cars, though. If the car isn’t worth enough at the end of your Term, it’s not worth taking back. HP is a better choice for older used cars.

PCP

With a PCP you could end up paying for a big chunk of the car’s value and still walk away with nothing if you can’t afford the Balloon Payment. There’s no saving up for a final lump sum with HP – you’re paying as you go. A PCP makes it easy to upgrade your car to a newer model at the end of your Finance but there’s nothing stopping you from selling your car and buying another once you’ve finished your HP Agreement. A PCP does simplify that calculation, however. PCPs give you more choice at the end of your Finance. You can Return, Upgrade or Buy your car outright – whatever you want. HP is a simpler transaction but you can do less with it. PCPs are often easier to fit into your monthly finances. You’ll pay less every month than you would with Hire Purchase and this alone could justify opting for a PCP, even if you hand the car back at the end.

Tips for Choosing the Right Hire Purchase Deal.

-

Pay More Up Front

Paying more in your Deposit makes a big difference to your monthly costs. There will be less money to split over your Term so your month-by-month cost will come down. You’ll also pay less in APR over the length of your Term and that all adds up! Remember: you can trade in your old car and use this towards your Deposit. Why not pay a lump sum and trade in?

-

Shop Around for APR

APR is a number that represents the Fees and i=Interest paid on a Loan. The higher the number, the more you’ll pay. So find the quote with the lowest APR – maybe even tell another lender what you’ve been offered elsewhere and see if they’ll beat it? Even better: our Personal Car Buyers will do this for you!

-

Use A Finance Calculator

Using a Finance Calculator, like ChooseMyCar’s, lets you to compare and contrast. Longer term, more deposit, less deposit, shorter term – find out what is likely to get you the best monthly cost and lowest price overall.

Hire Purchase may be the simplest way to buy a car on Finance but that doesn’t mean there aren’t ways to make it cheaper, or deals to be done. Talk to one of ChooseMyCar’s Personal Car Buyers now and see how we can help.

Just call 01617681543 or contact us at hello@choosemycar.com now and see how we can negotiate the very best deal. Put us to the test and drive away happy.