What Is PCP Car Finance?

Compare Personal Contract Purchase (PCP) deals and you could decrease your monthly expenditures.

- Lower Monthly Payments

- Flexibility at End of Term

- Easy Vehicle Upgrades

Rates from 9.9% APR. Representative APR 21.9%. ChooseMyCar is a credit broker, not a lender.

Understanding Personal Contract Purchase (PCP)

More than 3/4s of all cars are now bought with Personal Contract Purchase Finance, or PCP. But what is it, how does it work and how can you get the best PCP deal with ChooseMyCar?

Let’s dive into the flexible world of PCPs…

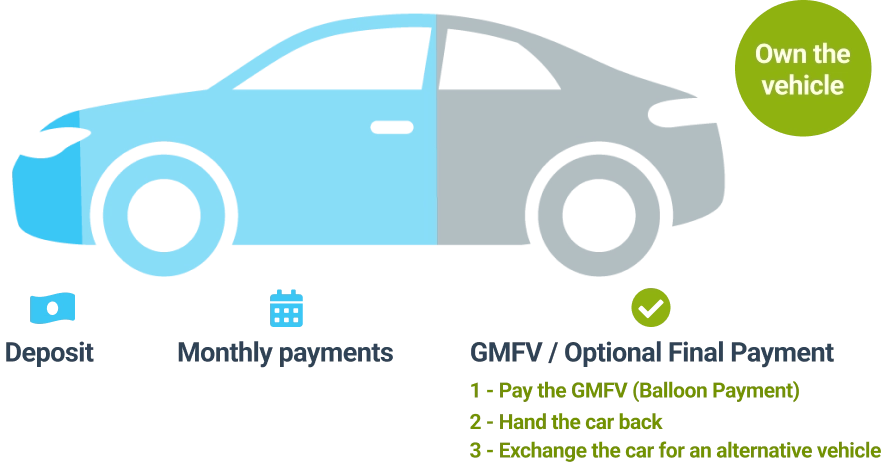

PCP is Car Finance in three parts.

It’s car finance that puts you in the driving seat.

PCP Finance Calculator

Estimated Monthly Budget

Total Cost of Credit

£22,258

Optional Final Payment

£0

Pros and Cons of Personal Contract Purchase

Pros of Personal Contract Purchase

-

Flexibility

A PCP deal is the most flexible type of Car Finance on the market. Want lower monthly payments? Sure, that can be arranged. Want to upgrade after 3 years? Yup, step this way. Want to drive your car for longer? We can do that too. Want to walk away at the end of the contract? There’s the door. With a PCP deal, the world’s your oyster. -

Cheaper Every Month

With a deposit up front and a “balloon payment” held back to the end of the finance term, the amount you pay monthly is only a small chunk of the total value of the car – and much lower than you’d pay with Hire Purchase. Essentially, all you’re paying for is the expected depreciation of your car over the term of your finance, plus APR. This can save you a small fortune every month. -

A Newer, Better Car

If you want the newest bells and whistles every few years, a PCP is ideal. Want the latest tech? Get it. Want to swap out for an Electric car in a few years without breaking the bank? You can do it.when you need it.

Cons of Personal Contract Purchase

-

Balloon Payments Can Be Pricey

If you want to keep the car then you’ll need to start saving up. At the end of the finance term you’ll need to pay off the remaining value of the car in a single lump sum if you want to drive it away – that can be £thousands. -

Walking Away Can Hurt Your Wallet

If you decide to hand your car back at the end of the term then you won’t have any assets left over. You’ll have paid for the use of the car but the car won’t be yours, so you can’t use it as a deposit on your next. If you start a new PCP with the same provider and a new car, however, the residual value of that car will be used to help lower the monthly cost of your next. -

Older Vehicles May Not Be Accepted

Because the final value of the vehicle is factored into all the fiddly calculations a lender will make, older cars – those that’ll be 13 years old or more by the end of the finance – may not be covered. They probably won’t be worth enough to make it worthwhile to the lender if you hand them back.

How to calculate your PCP payments

-

The Price of The Car

The price of the car you want dictates the amount you want to borrow. The more expensive the car, the more it will cost overall.

-

Depreciation

Here’s where it gets interesting. Find a car that’s likely to depreciate less and your monthly repayments might actually go down. Cars with lots of options, bells and whistles might actually cost less per month than bare bones models because they hold their value better.

-

Your Deposit

The more money you put in up-front, the lower your monthly repayments and the less you’ll pay in APR overall but remember: If you hand your car back and walk away at the end you don’t get your deposit back.

-

The length of Your Contract

PCP contracts usually last between 2 and 4 years. The longer the repayment period, the less you’ll pay each month but the more you’ll pay overall in APR and Fees. The shorter your contract, the cheaper it’ll be in APR but it might cost you more each month.

-

Annual Mileage

The more money you put in up-front, the lower your monthly repayments and the less you’ll pay in APR overall but remember: If you hand your car back and walk away at the end you don’t get your deposit back.

-

Interest and Fees

Lenders make their money by charging Interest and Fees – commonly called “APR”. The higher this number, the more your Car Finance will cost you overall. Cross shop for the lowest APR number and remember: you can negotiate this so barter away (*we do this for you – talk to your Personal Car Shopper.)

Personal Contract Purchase: How is It Different?

Hire purchase

Hire Purchase deals split your Car Finance into two parts: your Deposit and your Monthly Repayments. Your repayments cover the entire remaining cost of the car, meaning they cost much more a month. Unlike PCP, you always walk away with a car at the end – so long as you keep up the repayments. If you want to swap to a new model (you hussey) or hand it back, however, you’re out of luck.

Leasing

Leasing is often cheaper each month than either PCP or Hire Purchase. The difference here is that you never own the car: it’s the Leasing Company’s – you’re just paying to use it. At the end of your Finance you have to give it back – no ifs, no buts.

Tips for Choosing the Right PCP Deal

-

Watch Out For the APR

Lenders will say it’s “representative”: this means that it’s the average amount they lend to most people and may not be what they offer you. Keep it in mind, though, as lenders with lower “representative” APRs are likely to be cheaper.

-

Check the Balloon Payment

Lenders will have different ways of assessing how much your car will be worth at the end of your agreement. This means that Lenders might have different Balloon payments and this will impact the amount you’re likely to pay each month, even if you plan on handing it back. Higher Balloon Payments usually = Lower Monthlies.

-

Shop Around

This is the easiest bit because our Personal Car Shoppers do this for you. Talk to them about the offers you’ve received and they’ll see if they can get you a better deal. Remember: APR is negotiable and so is Finance. Like one deal but want a different lender? Talk to us and we’ll see if we can switch it up.

If you want to know about PCPs, or if you want to arrange one for your next car, call us on 01617681543 or click here

to talk to one of our expert Personal Car Shoppers today.