What Documents Do I Need for Car Finance 2025?

[Complete Guide]

Getting car finance approval in 2025 starts with having the right documentation ready.

Our comprehensive guide covers everything you need to submit a successful application and get approved quickly.

Essential Documents for Car Finance Applications 2025

The car finance application process requires three main types of documentation. Having these ready before you apply can speed up your approval:

Proof of Identity Documents

Valid identification is crucial for your car finance application. You’ll need to provide:

- A current UK driving licence (full or provisional).

- Valid passport.

- Birth certificate (if additional verification is needed).

Proof of Address Requirements

Lenders need to verify your address with recent documents from the last 3 months:

- Recent utility bills.

- Council tax statements.

- Bank statements showing your current address.

- Electoral roll confirmation.

Income Verification Documents

Proving your income is essential for car finance approval:

- Last 3 months of payslips.

- Recent bank statements.

- Latest P60.

- Employment contract.

Special Circumstances Car Finance Documentation

Different circumstances may require additional documentation. Here’s what you need to know if you’re self-employed or are applying for car finance with bad credit.

Self-Employed Car Finance Documents

Self-employed applicants need additional documentation:

- 2 years of business accounts.

- SA302 tax calculations.

- VAT returns (if applicable).

- Business bank statements.

Bad Credit Car Finance Requirements

If you have bad credit, these additional documents can help:

- Proof of benefits (if applicable).

- Evidence of regular bill payments.

- Additional bank statements.

- Explanation of past credit issues.

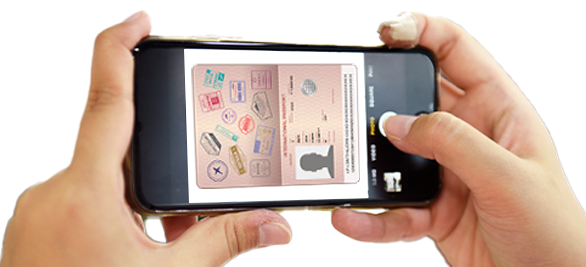

How to Submit Documents for Car Finance

Most lenders now offer convenient digital document submission options. You can typically upload your documents through a secure online portal or mobile app. This streamlines the application process and helps you get a faster decision.

Digital Document Submission

Making your application is easy with our secure upload system:

- Clear photos or scans are accepted.

- All pages must be included.

- Information must clearly visible.

Document Security

Your information is protected with:

- SSL encryption.

- GDPR compliance.

- Secure storage systems.

Car Finance Document Checklist

Before You Apply

- Valid ID

- Recent proof of address

- Income documentation

- Additional supporting documents

Car Finance Application Process

-

Check eligibility

-

Upload documents

-

Receive quick decision

-

Get approved

Why Choose Us for Car Finance?

Our approval process is designed for success:

- 95% approval rate.

- Same-day decisions available.

- All credit histories considered.

- Competitive rates guaranteed.

- Hire Purchase (HP) & Personal Contract Purchase (PCP) available.

Representative example:

Borrowing £9,000 over 60 months with a representative APR of 21.9%, an annual interest rate of 21.9% (Fixed) and a deposit of £0.00, the amount payable would be £238.28 per month, with a total cost of credit of £5,296.90 and a total amount payable of £14,296.90

Document requirements may vary based on circumstances and lender criteria. Information updated February 2024.